The VA Loan

The VA loan is a $0 down mortgage option available to Veterans, Service Members and select military spouses. VA loans are issued by private lenders, such as a mortgage company or bank, and guaranteed by the U.S. Department of Veterans Affairs (VA).

The VA Home Loan was created in 1944 by the United States government to help returning service members purchase homes without needing a down payment or excellent credit. This historic benefit program has guaranteed more than 24 million VA loans, helping veterans, active duty military members and their families purchase or refinance a home.

General Assumptions

Throughout this, when giving examples, I’m making the following assumptions (stating it here just so I don’t have to keep repeating) – variations can significantly affect the numbers, obviously, so always keep that in mind.

Purchase price $500,000

Annual property taxes: $2,200 for a $500,000 house in Tacoma, WA. In some states annual property taxes for a $500,000 house can be more than $10,000 so always check this the property taxes for that area

Annual homeowners insurance: $1,000 a year – this is obviously where shopping around is important. USAA and Amica both have well-reviewed policies, but still should be in the ballpark on price. Consider a mortgage broker.

Breaking down the mortgage payment and what you can qualify for

Your monthly mortgage payment is made up of elements called “PITIA” - Principal, Interest, Taxes, Insurance, Assessments

Principal & Interest: This is the actual loan for the house. In excel you can calculate this as =PMT(Rate, Months, InitialValue)

Rate = your monthly interest rate (so your interest rate divided by 12)

Months = number of months (30 years is 360 months)

InitialValue = initial loan balance as a negative number

For example, to calculate the P&I for a $500k loan at 3.25% for 30 years, use the following formula: =PMT(.0325/12,360,-500000) = $2,176.03 per month

For a 30-year fixed rate mortgage (the vast majority of mortgages), this monthly payment will never change unless you refinance down the line

Taxes: Estimating $2200/year so $183.33/mo

Insurance: Estimating $1000,year so 83.33/mo

Assessments: This is for HOA dues, etc. Usually this isn’t actually paid through your monthly payments and you have to pay it separately, but it’s at least used to calculate what you can qualify for. In this case assume $0 to make things easy.

Total Monthly Payment: For this example, assume the following $2176.03 + 183.33 + 83.33 = $2442.69/mo

How To Get Qualified

There are three main things you have to meet to qualify for a mortgage:

Credit Score: You’ll need a 620 to get decent rates, anything above 680 on a VA and you’ll qualify for the best rates.

Conventional loans have their best rates up to 740, but even the very best conventional rate will usually be much worse than any VA rate

Debt to Income Ratio: This is just a pass/fail.

Debt – all of your recurring debt payments:

This projected monthly payment of $2443

Car payments

Personal loans

Credit cards that you have to make monthly payments on

Other installment/school loans, etc.

Basically anything that shows up on your Credit Report with a monthly payment

Income: Your gross, pre-tax income (for this example assume you’re an O4 with 12 years of service in Fort Lewis, with no other income:

Base Pay $7832

BAH $2433

Assume 10,265 pre tax monthly income

DTI Ratio generally needs to be less than 55% for a VA loan (some lenders require lower, some allow higher) – this means that your total debt payments need to be 55% or less of your monthly pre-tax income – so in this example, no more than $5645 of debt payments allowed.

If you have no other debt, this means that you can qualify for a mortgage that costs $5645/mo. If, say you have $500 in personal loans, $1000 in car loans, and $500 in credit card debt, then you qualify for a mortgage that is (5645-500-1000-500=) $3645/mo.

The bottom line here is that you will almost always qualify for something way more expensive than you’re comfortable with.

Therefore, the most important thing is to figure out what payments you’re comfortable with, and then look at houses in that price range. Then, you have to decide if you are willing afford that payment. How much do you spend on trips? eating out? Toys? etc? Some people are shut-ins and never leave their home - they can probably afford more because they don't have to budget for other stuff. If you spend a lot of money on other stuff, then a more expensive house will hurt your ability to do what you like.

VA Residual Income – VA has a final check where they look at your after-tax income, those same debt payments, and an estimate of monthly utilities/maintenance costs based on location and size of the home, to make sure you have enough residual income.

In your case this will likely not be a concern (unless you’re buying some multi-million dollar mansion), but good to know just in case you hear the term at some point.

Down Payment and Funding Fee

As of Jan, 1, 2020, you can now put zero down on a new purchase of any house price you want (previously you would have to put down a small down payment on the amount above ~$480,000, varying by county). Note that in the future if you buy a second house with a VA loan while you still have this one (with intent to keep both), that ~$480k limit comes back into play, but not a big deal for right now.

VA rating depends on how much (if any) you put down on the house. You’ll see later, that it’s probably not worth putting any money down.

If you have a VA disability rating of 10% or higher, you are exempt from the funding fee (this will come into play after you eventually get out)

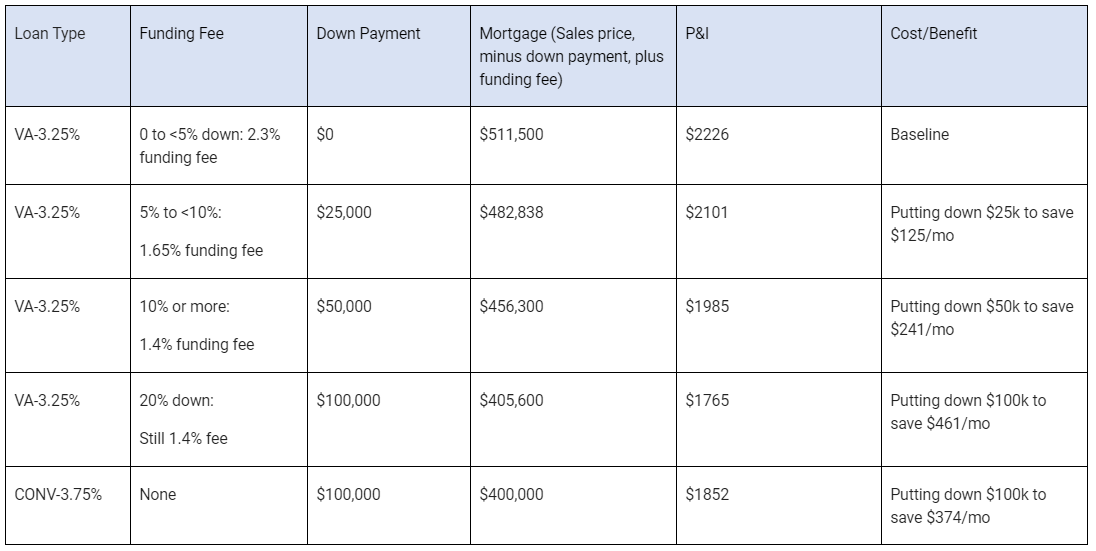

Funding Fee Table (note that you’ll see some outdated numbers on the internet since this was recently changed – my number are from the following. Let’s assume you’re buying a $500,000 house, and that you’re looking at either a 3.25% interest rate for a 30 year VA loan or a 3.75% interest rate on a conventional mortgage (note that in the conventional example, you’re putting down 20% to avoid paying PMI.

So, everyone has different preferences, balance the funding fee that gets added to your loan with the amount you want to avoid putting down. A couple obvious notes:

Because there's no PMI, there is zero point in putting down any more than 10%, and the benefit of putting down 10% itself is dubious.

Down Payment and Opportunity Cost

When figuring out if (or how much) of a down payment to put down, it’s all about opportunity cost. I’d recommend that first, make sure that you have a healthy emergency fund, second make sure you have a good investment plan. Then, put whatever excess money you have leftover into a down payment, but don’t stress over it.

Benefits of a down payment:

More equity up front, reduces the risk that you go underwater on the house (owing more than its worth)

Guaranteed savings (a $10,000 down payment guarantees you aren’t paying interest on that 3.25%)

Risks of a down payment:

Reduces ability to invest (S&P 500 averages, like 8% a year and was 24-25% last year – you could make a lot more money with that $50k earning 8% invested instead of sitting in a house saving 4% - but the investments aren’t guaranteed while interest savings from a down payment ARE guaranteed, so keep that in mind as well)

Illiquid: if you don’t have an emergency fund set up and you have to pull the money back out of the house, you have to do a cash-out refinance – another set of closing costs and it can take two months to do. Also, it depends on how high your house appraises for so you might not be able to get out what you originally put in.

Payment Savings

Comparing the payments in the chart above, you see that:

5% down will save you $125/mo but cost you $25,000 down. You'll earn that down payment back after (25000/125=) 200 months, or a little over 16.5 years.

10% down will save you $241/mo for $50,000 down. Payback period of 207 months.

The payback period is even longer if you have no funding fee (in the future when you’re getting them VA disability checks) to where it’s even more of a no-brainer.

So bottom line, putting down a down payment is not worth it from the standpoint of payment savings - it'll take you at least 16 years (or more) to recoup that down payment - and that down payment sits as dead money in your house, instead of growing in your investment accounts. There are two other arguments for a down payment:

Savings on PMI.

With conventional and FHA loans, you get better terms on PMI with higher down payments. That obviously doesn't apply here, so let's move on. (Note that this is the primary reason you should put down a higher down payment on non-VA loans - the idea that you want equity in the house is a little misguided, as we get to below)

Equity

There is a common misconception here. The "conventional wisdom" says that you should put down a downpayment, because if you sell the house early or the value drops instead of rising, you want to have a buffer before you start losing. This is misguided. A lack of equity is ONLY dangerous if you don't actually have any money that you can pay in the event that you need to. For example, if you had $0 in investment accounts, I would think twice about putting $0 down. If you have the money to make a 20% down payment, it's better to keep that invested in other accounts, and make as low a down payment as possible. Here's why:

Being upside down on a house only matters when you sell. If it turns into a long term home (probably not the case here, but bear with me), then it doesn't matter what happens to values - the payment remains the same regardless of current market values, so it's not like losing value suddenly makes it hard for you to afford to keep the house. Now, if you lost your job, that would be a different story, but that would still be independent of how much you bought the house for.

If you are underwater on a house when you sell, you're losing money, down payment or not. For example, let's say you buy a $500,000 house. You have $75,000 and can either put that all down, or keep it in your investment account. Let's say that 2 years from now, you have to sell, but you can only get $475,000 for it. In addition, let's say that you incur 10% in costs to sell the house - 3% to your agent, 3% to the buyer's agent, and 4% for repairs and concessions to the buyer (just hypothetical here). So, you bought a house for $500,000, are selling it for $475,000, and deducting $47,500 from that to cover the costs of selling, leaving you with a net of $427,500. Let's see what happens:

Down Payment. You followed the "conventional wisdom" and put down $75,000 and took a $430,950 loan ($425k + 1.4% funding fee). After 2 years, that loan balance is down to $413,400. You find a buyer for $475,000 minus $47,500 (selling costs) minus $413,400 (loan balance) = $14,100 back at closing. In reality, you paid in $75,000 down + $45,012 in monthly mortgage payments (not including tax/insurance since they are the same no matter what), and got back $14,100. This house cost you $105,912 for the 2 years that you lived there. That loss in home value hurts you no matter how much down you put. Let's go to the zero down option:

Zero Down Option. Let's say you put $0 down. Instead, you keep that $75k in the stock market and it grows at 6% a year (let's keep it conservative). So, you take a $511,500 loan (incl. 2.3% funding fee), and the same thing - after 2 years, you owe $490,680, sell for $475k (underwater), subtract $47.5k for costs, leaving you with a net of $427.5k. That means that you’re short $63,180 that you have to pay out of pocket to your mortgage company. In order to come up with the difference, you have to withdraw that cash from your investment account (which you would have done at the beginning if you were making a down payment). However, that $75k was growing over two years, 6% a year. So, when you withdraw it, that $75k has turned into $84,270 and you can easily cover the difference (whether on the front or the back end, you still had to pay for that loss in home value, but investing made the sting smaller at closing time).

Now, your total cost of living in the house was: $0 down, plus $53,425.92 in mortgage payments, plus $63,180, minus the $9,270 that your would-be down payment earned while invested, for a total cost of $107,336 for two years.

In this example, there was a small difference in your cost in a sad example of having to sell your house in a down market. And, if the investment returns were higher, you could potentially MAKE money by putting zero down. This is the key that people forget - being underwater on a house only matters when you sell and if you didn't have the money to put down in the first place.

This is at a pretty rough time horizon of 2 years and a downturn – if you had more time for the cash to grow, it rapidly outpaces the down payment option.

You would be screwed if you put $0 down, but didn't have any money available for a down payment in the first place. In that case, you'd either have to stay in the house, or rent it out until the value rose (or your balance dropped) enough that you'd be able to pay everything off. Or look at a short sale, return to bank, foreclosure, etc.

Of course, this is all a moot point if the house rises in value - so it will depend on your area, as well.

Discount Points or “Prepaid Interest”

Discount points are essentially an extra closing cost that you pay in exchange for a lower interest rate. One “point” is equal to one percent of the loan value (so on a $500k loan, 1 discount point is $5k, on a $100k loan it would only be $1k, etc.)

Pro: long term, it saves you interest over the life of the loan, and reduces your monthly payment.

Con: it costs money, so whether or not it's a good option depends on how long you'll be in the house before you sell or refinance.

For example, if $1000 in discount points will save you $50 in interest on your monthly payment, then the payoff is (1000/50=) 20 months, or one year, 8 months. It will take 20 months before your savings makes up for the cost, so as long as you're in the house that long, it makes sense.

However, let's say that it's $5,000 and saves you $50/mo. Now the payoff is 100 months, or more than 8 years.

If you know 100% that you'll be in the house longer than that (the average mortgage life is 4-7 years), then great! But, let's say that you move out after 4 years. 4 years' worth of payments saves you (50*48=) $2400 in monthly payments, but you paid $5000 up front to get it.

You can calculate interest saved over the life of the loan - just remember that if you calculate how much you'll save after 10 years, for example, then you actually have to be in the house 10 years for that to materialize.

Other notes:

The ratio of “points” to “interest rate reduction” is not linear. For example, a lender might offer you 3.5% with no discount points, 3.375% with 0.5 points, 3.25% with 1.5 pts, 3.125 with 4 pts, etc. There isn't a standard and it just depends on the specific lender and where rates are at that point in the day.

The opposite of a discount point is a lender credit – some can offer a credit just because, but you can also ask for a higher interest rate in return for the lender credit to pay down closing costs, etc.

Closing Costs

All mortgages will have closing costs – these are payments generally to cover the following:

Lender fees

Title/settlement company fees

Any lawyer fees

State/county taxes

Escrow set up

Someone will always pay the closing costs – it’s traditionally a split between you and the seller.

How much (if any) the seller will cover will depend on the market and your/your realtor's negotiating skills.

In a slow market, sellers might be willing to pay most or all of your closing costs

In a hot market, sellers might not entertain any requests like this, or only consider it if you’re willing to agree to a higher price (to a seller, an offer of $500,000 with no closing cost concessions is the same as an offer of $510,000 with $10,000 in closing cost concessions, but there is a psychological aspect to stuck up sellers, too)

You can ask the lender to cover all closing costs in exchange for a higher interest rate

You could potentially refinance cheaply later into a VA loan (the refinance would have a 0.5% funding fee instead of the 2.3%), but those would be last-resort options because now you have two sets of closing costs and it only works if rates fall during that time (note that I did this on my last house purchase)

Credit Report Pulls and Shopping Around

It's good to shop beforehand, but there are some caveats.

First, don't worry about multiple hard pulls - this is not an issue with mortgages. The CFPB mandates that any mortgage credit pulls done within a 45-day window of each other must be counted as one pull for credit score purposes (link), and anybody who tells you that shopping around will hurt your credit is either misinformed, or deliberately trying to scare you away from shopping around.

It’s usually better to work with one lender at first, and then shop around once you have a signed contract with a seller.

The only concern with shopping lenders before having a signed contract is that many lenders will lie to you to lock up your business. This is because they won't have to lock your rate until after your contract is signed, so if you're in the pre-contract phase, lenders will be a little looser with quoted rates.

For example, let's say I'm a shady lender and I know that you're shopping around. I know that for this given loan, I would be at 4%, but I know all my competitors will offer you 3.75%. Well, I know you haven't even found a house yet, so I'll tell you that at today's rates I'd be at 3.625% (straight lie). You think "great, I'll go with this guy, they're the cheapest)." Two weeks later, you bring a signed contract and I tell you "geez, sorry, rates went up and we're at 4% today," or "geez, it looks like your credit score no longer qualifies for 3.625%, we'll have to lock you in a 4%" etc. You got bait-and-switched. Now, the other lenders might be doing the same thing, or they might really be at 3.75%. However, as the shady lender, I'm hoping that you've already invested enough time with me, and made the choice to go with me, so you'll just accept the rate and face value.

So, the bottom line is that you only need one pre approval (from a reputable lender), and then you shop lenders when you are ready to lock a rate "that day" - you'll significantly cut down the BS teaser rates from lenders who will try to bait you to them.

You can still shop before the preapproval, and see who you like working with - just be aware that you'll want to shop around again after the contract is in hand, especially if you find that rates went up. Of course, many times rates actually DO go up, so your mileage may vary - just understand that it makes a great cover for the unscrupulous types out there.

Closing Thoughts

The only time that VA isn't the best solution is if you're trying to buy a run down house that needs a lot of work - VA loans allow old, outdated homes, but they must be "move-in ready" - all windows intact, heater working, no lead paint hazards, etc (which sellers can sometimes get antsy about).

But, aside from that, the VA will always save you money compared to conventional, no matter how much you put down.

Your only real concern at this point should be whether or not you want to put a down payment in.

At lower prices points ($2-300k) the funding fee isn’t such a big deal, but at the prices you’re looking, it definitely factors into consideration.